05 Oct Natural Gas on the Fast Track as Oil Continues to Struggle

Oil and gas appear to be headed in different directions as far as overall outlook for the moment at least. Gas prices continue to fall as crude oil barrels hover around some of the lowest rates seen in years, but one sector of drill rig companies should see a boost soon. A recent report from Cobank, the agricultural credit bank, shows positive signs for the demand for natural gas from the United States, according to the industry news site OilandGasinvestor.com.

The report, “U.S. Natural Gas Outlook through 2020: Demand is the new Captain of the Ship,” estimates that the demand will grow by 25% over the next five years, and more than half that growth will come from U.S. natural gas exports. Taylor Gunn is a Senior Economist in Cobank’s Knowledge Exchange Division, the company’s knowledge-sharing arm that provides important insights about industries Cobank serves, and author of the report.

“It’s definitely a game changer for the global gas markets,” said Gunn in a statement.

The report also predicts that within two years the U.S. will become a net exporter of natural gas, which could position the country as a major provider on the global energy markets. It also believes that while the demand will continue to grow, the price should stay relatively neutral thanks to the vast amount of supply the industry already has stored.

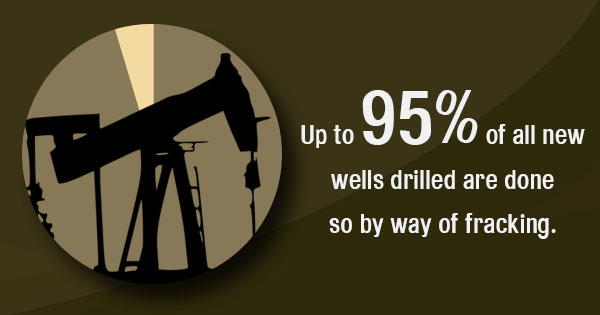

A large portion of this increase can be attributed to the growth of hydraulic fracturing as opposed to traditional oil and gas drilling methods. In 2013 there were at least two million hydraulically fractured oil and gas wells in the U.S. and up to 95% of all news wells drilled are done so by way of fracking, according to the Department of Energy (DOE). The production of shale is also expected to rise to 13.6 trillion cubic feet, which would represent almost 50% of all U.S. natural gas production by 2035, according to the Energy Information Administration (EIA).

Data reported by the investment research and analytics firm, MarketRealist.com, support many of the claims in the Cobank report. The price of natural gas remains stagnant, while the stockpile increased for the 25th consecutive week (September 24).

It will be a while before oil loses significant power in the industry, but natural gas is certainly on its way to taking a shot at the top. There are currently about 9.8 million people employed in the oil and gas industry in the U.S. alone. If these trends continue chances are many of them will find themselves on the natural gas side before too long.

Sorry, the comment form is closed at this time.